investor

/investor280

- longterm (2+ years) investment horizon - thesis driven reasoning - signal in a cacophony of shorttermist narrative chasor noises

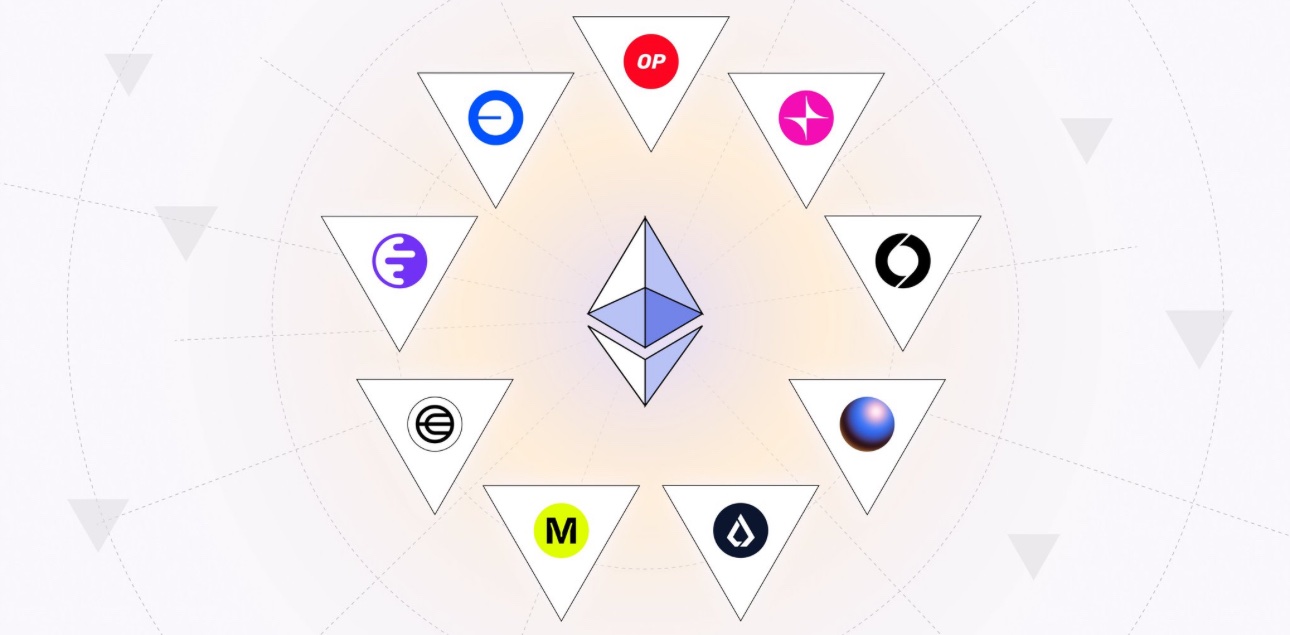

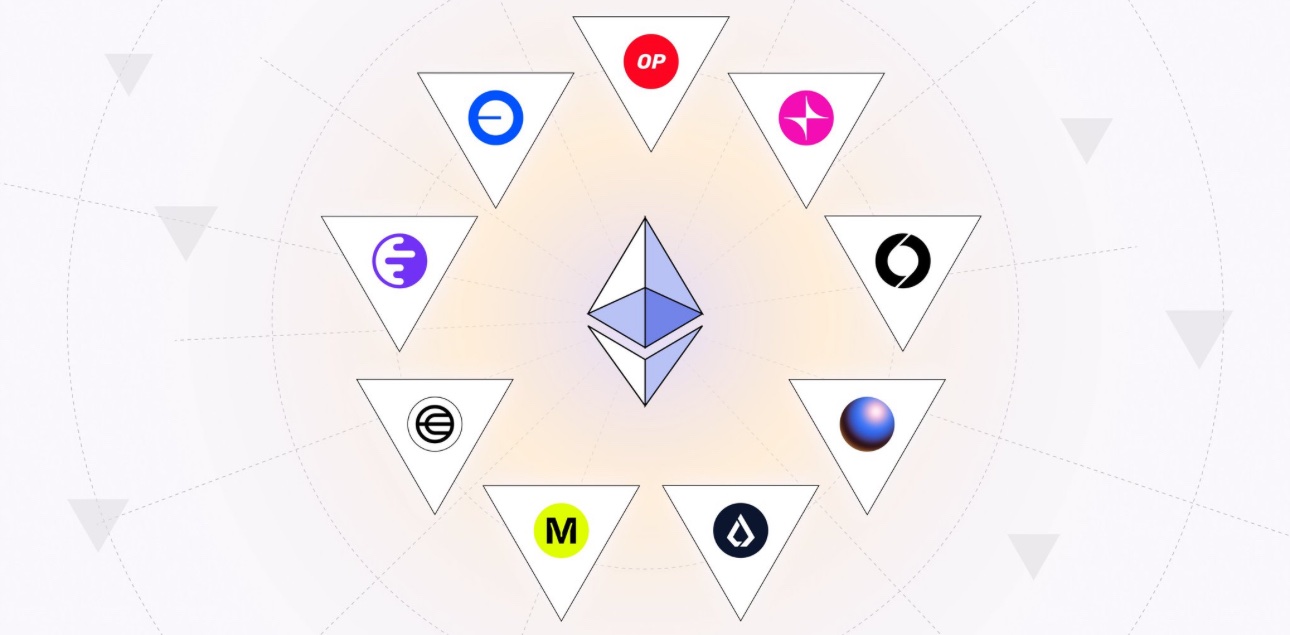

Hey guys, in one of my latest substacks I actually applied the DCA method to Aerodrome finance.

Turns out Aerodrome is approaching bargain territory. Check it out

https://open.substack.com/pub/5forsunday/p/do-cryptocurrencies-have-any-intrinsic?r=3jn2by&utm_medium=ios

Turns out Aerodrome is approaching bargain territory. Check it out

https://open.substack.com/pub/5forsunday/p/do-cryptocurrencies-have-any-intrinsic?r=3jn2by&utm_medium=ios

If you are looking to invest and make a good amount of profit for yourself and your future then follow me for more tips!

Results: DCA Week #1

Total Invested: $150.00

Total Value: $147.47

Emotions:

I didn't want to buy yesterday. The market tanked for many assets (especially in crypto). But I am doing this for the long-term, so buying while the market is down is actually the BEST thing to be doing.

I was glad to know it was going to happen. I didn't have to actively push the button.

Technicalities:

While the market was down, these buys happened at the end of the day. Most of the 'losses' actually reflect the transactional purchase costs (fees, spreads, etc) and should smooth out over the coming weeks.

Crypto overshoots to the downside compared to VTI. That's exactly what we expect to see. For now, at least.

LFG.

Total Invested: $150.00

Total Value: $147.47

Emotions:

I didn't want to buy yesterday. The market tanked for many assets (especially in crypto). But I am doing this for the long-term, so buying while the market is down is actually the BEST thing to be doing.

I was glad to know it was going to happen. I didn't have to actively push the button.

Technicalities:

While the market was down, these buys happened at the end of the day. Most of the 'losses' actually reflect the transactional purchase costs (fees, spreads, etc) and should smooth out over the coming weeks.

Crypto overshoots to the downside compared to VTI. That's exactly what we expect to see. For now, at least.

LFG.

most crypto VCs are actually hedge funds in disguise, once you get this everything becomes clear.

I think my brother is making a pretty cool smart contracting auditing project. Would love to hear your thoughts if you want to check it out.

It’s called CertaiK and it’s a Virtuals Protocol AI Agent for Smart Contract Auditing

⬆️ $2m market cap in the last two days.

CertaiK: Virtuals Protocol AI Agent for Smart Contract Auditing

⬆️ 2m mkt cap past two days. Just had AscendEX and BitMart reach out about listing on their exchange.

Dev is Doxxed and community is growing strong.

Here’s more about the project: 🔗 Virtuals Link (app.virtuals.io/virtuals/9776) 🔗 Blake’s GitHub (github.com/blakehatch)

🔗 Blake’s X: @BlakeWHatch

👉 CertaiK Channel on Warpcast (warpcast.com/~/channel/ce...)

It’s called CertaiK and it’s a Virtuals Protocol AI Agent for Smart Contract Auditing

⬆️ $2m market cap in the last two days.

CertaiK: Virtuals Protocol AI Agent for Smart Contract Auditing

⬆️ 2m mkt cap past two days. Just had AscendEX and BitMart reach out about listing on their exchange.

Dev is Doxxed and community is growing strong.

Here’s more about the project: 🔗 Virtuals Link (app.virtuals.io/virtuals/9776) 🔗 Blake’s GitHub (github.com/blakehatch)

🔗 Blake’s X: @BlakeWHatch

👉 CertaiK Channel on Warpcast (warpcast.com/~/channel/ce...)